The New Silk Road: How China Is Redefining the Global Trade Map

As President-elect Donald Trump prepares to take office, American businesses are stocking up on orders from China and are scrambling to diversify their supply chains in response to proposed trade policies. Trump has suggested implementing a 60% tariff on Chinese imports - a level most economists consider unlikely. However, while U.S. companies focus on these immediate tariff concerns, they’re missing a far more significant transformation in global trade.

Why You Should Care

Think this is just geopolitical chess? Think again given some of these staggering statistics:

40% of global container traffic now flows through Chinese-operated ports BRI ports, up from 22% in 2016 [UNCTAD Review of Maritime Transport 2023]

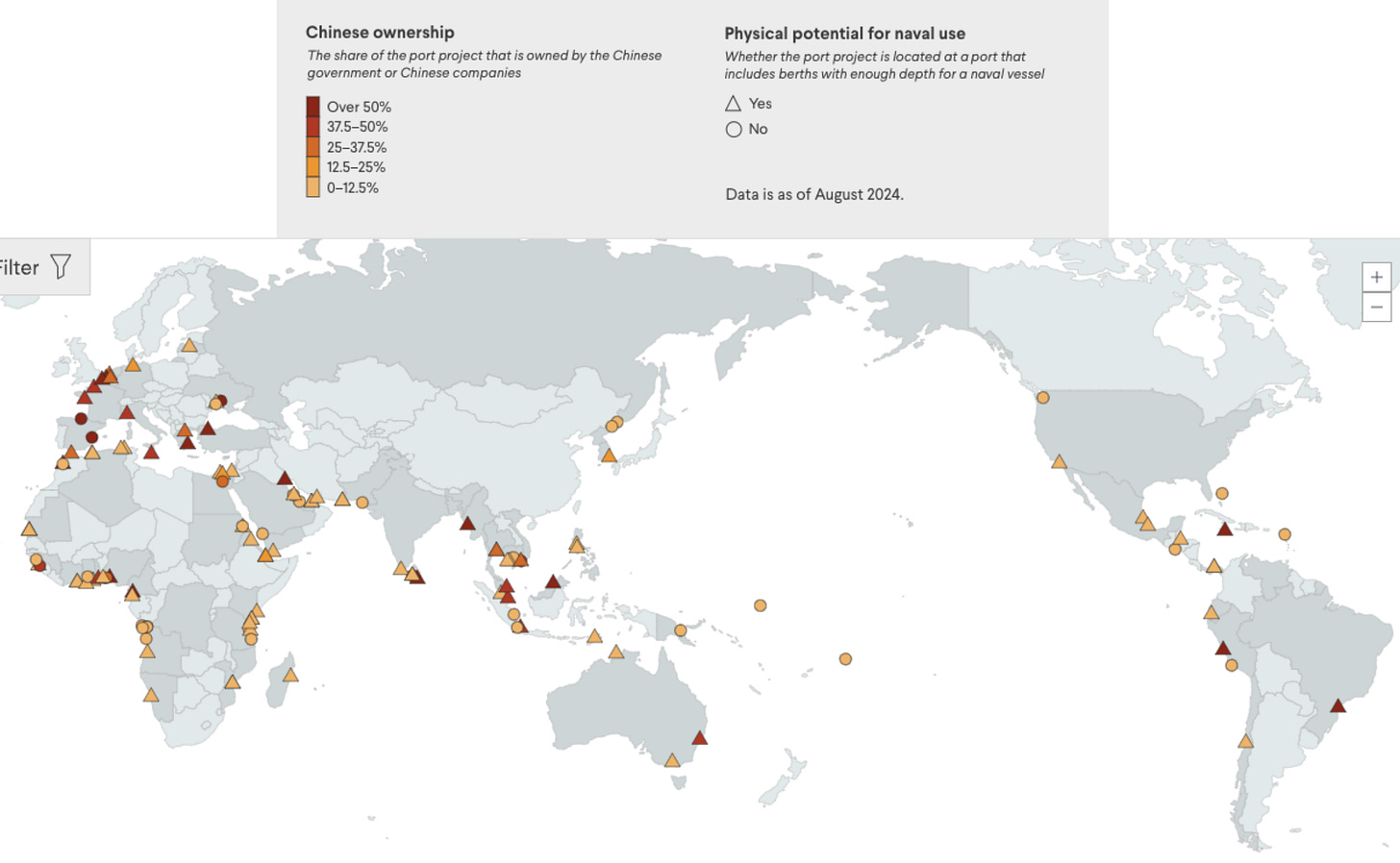

China has stakes (equity ownership and operational stake) in 129 ports worldwide

$50+ billion invested in port infrastructure globally

Chinese investment yields an average 20% efficiency improvement in ports

The Big Picture

Imagine a game of Go, where pieces are positioned long before the winning move. China's port strategy looks remarkably similar - they’re playing the longest game in maritime history. Their global footprint includes:

Europe: With 67% ownership in Greece’s Piraeus Port, they’ve transformed Europe’s fourth-largest container port from a struggling facility to a key play in EU trade

Africa: Their advanced digital infrastructure and smart port management systems now anchor key regions from Djibouti to Mombasa

Asia: Strategic investments in Pakistan, Sri Lanka, and Myanmar are creating a network that effectively circumvents India

The Master Plan

This infrastructure domination strategy began in 2013, when President Xi Jinping, launched the Belt and Road Initiatives (“BRI”) or “New Silk Road.” What started as a plan to link East Asia and Europe has expanded across Africa, Oceania, and Latin America. To date, 147 countries (out of 195) have signed on to projects or indicated interest to do so.

China’s strategy goes beyond just building infrastructure. Any analysis by the Kiel Institute for the World Economy and reveals that China’s financing contracts often include clauses that allow them to demand immediate repayment and restrict debt restructuring - giving them significant leverage over participating and developing nations.

Not Just Infrastructure

China isn’t just buying ports, they’re revolutionizing them. Their Guangzhou Nansha port is China’s first fully autonomous facility handled more than 920,000 containers in its first year of operation - all guided by a central operation system controlling intelligent guided vehicles (IGVs), cranes, and container trucks, making it one of the world’ most efficient ports with an annual throughput equivalents of 24 million standard containers.

Cranes - Shanghai Zhenhua Heavy Industries Company Limited (70% global market share in container cranes, 80% of cranes in US ports.

Logistics Management Systems - National Transportation and Logistics Public Platform

Autonomous Driving/Intelligent Dispatching - FABU Technology and Trunk Tech

Satellite Navigation/Spatial Intelligence- BeiDou Navigation Satellite System

5G Infra/IoT/Cloud - Huawei

Shipping/Logistics Management System/ERP - COSCO Shipping

Terminal Operating System - China Merchants Port

An Example

Consider the China-Pakistan Economic Corridor (CPEC) - a $62 billion investment connecting Pakistan’s Gwadar Port on the Arabian Sea. While this initiative is about developing Pakistan’s economy, it’s also creating an alternative to the vulnerable Malacca Strait, where narrow geography creates risks of collision, piracy, and disruptions.

The U.S. Challenge

While the U.S. pushes for supply chain independence and self-reliance, we face significant hurdles.

Infrastructure

Fragmented port systems operating independently

U.S. ports average 7 different operating systems per facility, creating inefficiencies in data sharing and operations [American Association of Port Authorities Survey 2023]

Only 8 of 50 major U.S. ports have fully automated container terminals versus 29 of 31 major Chinese ports [McKinsey Port Automation Study 2023]

Less funding with the U.S. Department of Transportation Maritime Administration announcing $580 million vs China’s billions

Privately owned ports with competing priorities

Some components of U.S. port infrastructure is heavily reliant on China

80% of container cranes at U.S. biggest ports are manufactured by Chinese companies [U.S. Maritime Administration Report 2023]

Seven of America's ten largest ports rely on Chinese-made terminal operating systems [Congressional Research Service Maritime Security Report 2023]

67% of U.S. port cyber incidents in 2022 involved compromised Chinese-made operating systems [GAO Maritime Cybersecurity Report 2023]

Labor & Technology

Union constraints limit operational hours, increase potential of labor disruption, and automation

Labor costs represent 40% of U.S. port operating costs vs. 8% in Chinese automated ports [McKinsey Global Institute Port Operations Study, 2023]

Shanghai's automated terminal at Yangshan Port processes 160 containers per hour versus 90-120 containers at major U.S. ports [Journal of Commerce, 2023]

Lack of national unified technology standards - each port runs its own Port Community System

This is how this will be affecting businesses.

Shipping Costs: Chinese-operated ports often offer preferential rates to Chinese vessels. As more ports join this network, shipping costs could become a competitive advantage—or disadvantage depending on who you are.

Chinese-operated ports process containers 20-30% faster on average compared to U.S. ports, with average vessel turnaround time of 18.4 hours vs 33.7 hours [IHS Markit Port Performance Report 2023]

Companies using BRI-connected ports save an average of $2,800 per container in logistics costs [Boston Consulting Group Global Trade Analysis 2023]

Vessels using BRI ports receive 15-20% lower insurance premiums due to standardized handling procedures [Lloyd's Maritime Intelligence Report 2023]

Supply Chain Control: Who controls the ports controls the pace of trade. During tensions, these chokepoints could become pressure points.

Chinese port management systems collect data from 65% of global maritime container movements [Financial Times Maritime Technology Analysis 2023]

Over 75% of U.S. ports rely on Chinese-made IoT sensors for container tracking [CSIS Port Security Assessment 2023]

Market Access: These modernized ports are creating new, faster trade routes. Early movers who understand this network will have an edge.

Chinese-operated ports offer preferential berthing windows to COSCO vessels, reducing wait times by 44% [Journal of Commerce Port Productivity Data 2023]

Ports using Chinese management systems process 92% of Asia-Europe rail freight [SUIC (International Union of Railways) Report 2023]

What's Next?

The race to supply chain dependency and independence will likely be driving innovation for decarbonization technology, automation, and trade route diversification.

Short-Term

African port investment to reach $50 billion by 2025 [African Development Bank Port Outlook 2023]

Western ports planning $25+ billion in automation upgrades [Port Technology International 2023]

Green port initiatives attracting $30 billion global investment [Maritime Sustainability Report 2023]

Medium-Term

EU's Global Gateway targeting $300 billion in port infrastructure to compete with BRI [European Commission 2023]

AI/automation to reduce port operating costs by 25-45% [McKinsey Future of Ports 2024]

Alternative Arctic shipping routes to handle 15% of Asia-Europe trade [Arctic Council Maritime Forecast 2023]

Long-Term Shifts

Green ports to process 60% of global maritime trade [UNCTAD Sustainable Shipping Outlook 2023]

Port automation to eliminate 40-70% of traditional port jobs [World Economic Forum Port Future 2023]

Autonomous vessels to account for 25% of new ship orders [Maritime Autonomous Surface Ships Report 2023]

💡 Key Takeaway: China's port strategy is reshaping global trade routes in ways that will affect every international business. Understanding this shift isn't optional—it's essential for future-proofing business supply chain.